Big businesses and local governments faced off Thursday in the state Capitol over a proposal that would change how property taxes are assessed for big box stores in Wisconsin.

Right now, big box stores can use the value of vacant stores to lower their own property taxes. For example, a store that does a lot of business can estimate that it’s worth the same as a vacant store that does no business at all.

Local governments that rely on property taxes are supporting a bipartisan bill that would end that practice, but business groups are fighting it.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

“It’s going to create a more hostile environment for commercial property owners, but other owners as well — manufacturing and others,” said Jason Culotta, senior director of government relations at Wisconsin Manufacturers and Commerce.

Culotta said the changes would lead to an unfair tax burden on businesses.

Supporters of the bill say it would ensure businesses are assessed more accurately. They argue the changes would ensure businesses aren’t getting special treatment, and are paying their fair share of taxes.

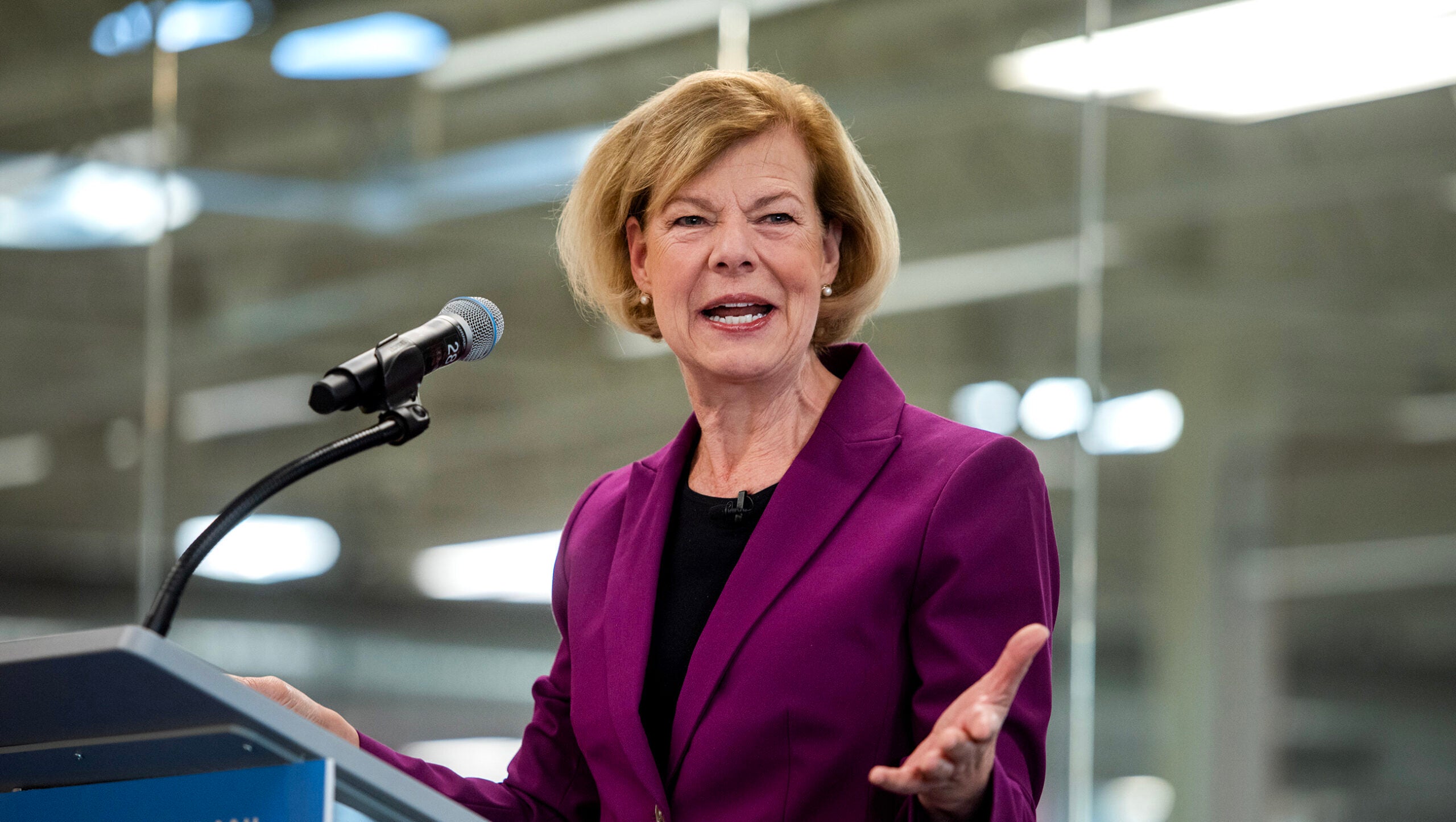

“If you’re an individual property tax, a residential property tax payer, you don’t get to say, ‘Well, I think I should be assessed on that foreclosed property in a different community,’” said Rep. Chris Taylor, D-Madison, during testimony.

The bill has yet to receive a vote in committee.

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.