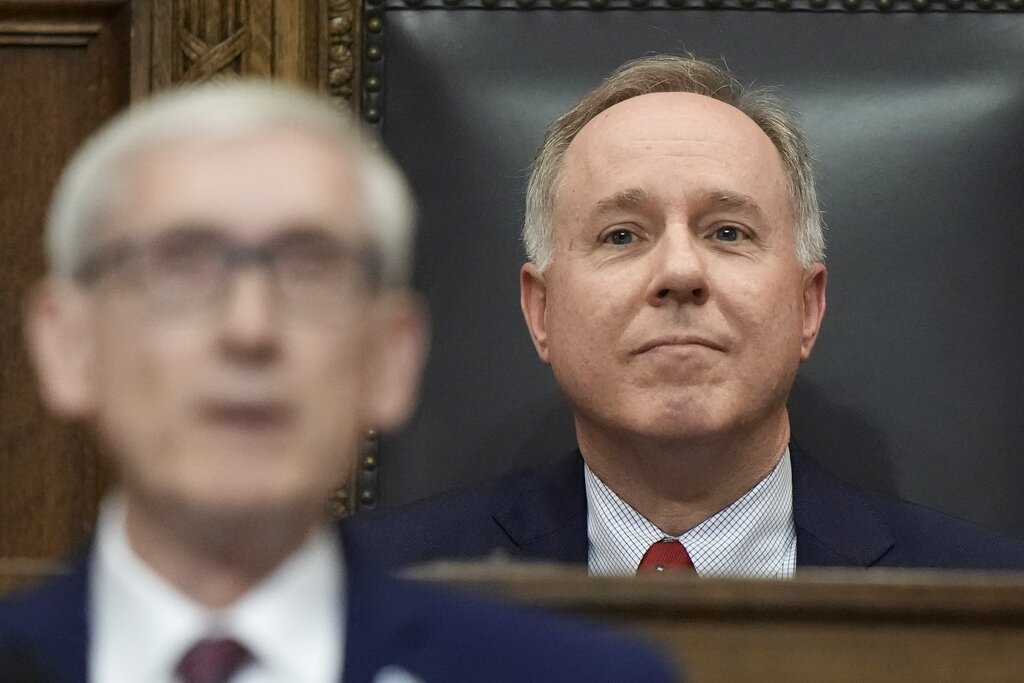

Documents obtained by Wisconsin Public Radio show that Assembly Speaker Robin Vos, R-Rochester, is behind a push to eliminate taxing authority of state technical colleges.

The measure was added as an amendment to an unrelated bill, which could see a vote Wednesday in the Assembly.

On Thursday last week, the Republican-led Assembly Committee on Ways and Means was set to vote on a bill at eliminating personal property taxes. But much of that language was included in a bipartisan shared revenue bill passed by the Legislature the day before.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

Instead, Ways and Means committee chair Rep. John Macco, R-Ledgeview, introduced a sweeping amendment that replaced the prior bill with language that would remove the ability of technical college boards to levy taxes to pay for operations and maintenance. Under the amendment, that funding would be replaced by state aid. According to the state Legislative Fiscal Bureau, tech colleges across Wisconsin raised around $250 million for operations from local property taxes in the current fiscal year.

While Macco was listed as the author of the proposal, drafting files requested by WPR show Vos requested the amendment, with the instructions to increase property tax relief aid to technical colleges and “eliminate the operating levy for technical colleges beginning with the 2023-24 fiscal year.”

Staff with Vos’ office did not respond to WPR requests for comment on his amendment.

Democratic Gov. Tony Evers told WPR he thinks the proposal is “a little shaky” unless there is additional revenue in the state budget to make up for the loss of local tax money for tech colleges.

“I think the technical colleges are doing a great job,” Evers said. “And I also believe that one of the reasons they are doing a great job is they have that connection with the local communities and local areas that help pay their taxes.”

Technical college leaders and others were blindsided by the major policy proposal. On Friday, Wisconsin Technical College System President Morna Foy said it would mark the biggest shift in how the schools are funded in more than 100 years. She said neither the system nor individual colleges were consulted ahead of Thursday’s vote.

The bill was approved by the committee on a party line vote on Thursday.

State Rep. Samba Baldeh, D-Madison, is a member of the Ways and Means Committee. He said the amendment was a surprise to Democrats too.

“That was basically the first time we heard of it, that morning of the (Thursday) hearing,” Baldeh said. “None of the technical colleges were aware of it. The sad thing was there was no public hearing at all.”

Baldeh said regardless of how the bill was introduced, it’s bad legislation aimed at stripping local control.

This isn’t the first time Republican lawmakers have addressed tech colleges’ share of local property taxes. In 2013, the GOP-controlled Legislature and former Gov. Scott Walker approved sending $406 million to technical colleges through the 2020-21 fiscal year, which reduced property taxes by an average of around 30 percent. That legislation reduced the amount of taxes going to tech school operations by nearly 65 percent from $615 million in the 2013-14 fiscal year to $215 million in the 2014-15 fiscal year. The legislation didn’t include any provisions restricting levying authority.

Because last week’s amendment was introduced without notice, few organizations have registered their support or opposition to the proposed change. One of those that did address the reworked bill was the Eau Claire Area Chamber of Commerce.

A letter from chamber President Dave Minor, who previously sat on a technical college board in northern Wisconsin, said the organization is concerned that “such a drastic change in the funding mechanism is moving towards enactment without a hearing or thorough discussion of the purposes, options and consequences.”

Minor said he is aware of concerns about keeping property taxes low in Wisconsin, but residents would be “hard-pressed to find a greater value” than schools like Chippewa Valley Technical College in Eau Claire.

As for replacing money from local property taxes with state aid, Minor said lawmakers can promise to fully fund tech colleges, but they cannot hold future legislatures accountable.

“What happens in five years or 10 years when delegations change in Madison or political parties change or whatever — you can’t guarantee that,” Minor said.

He said he hopes lawmakers will hold off on the change.

Technical colleges currently get funding from five major sources including property taxes, state aid and tuition. During the 2020-21 fiscal year, colleges across the state took in a total of $1.6 billion. Of that, $486.5 million (around 30 percent) came from property taxes, including operating levy revenues and $527 million (around 33 percent) came from state aid.

Chippewa Valley Technical College vice president of administration and chief strategy officer Caleb Cornelius said it would mean less certainty for tech schools.

“If the state does experience, at some point, an economic recession, one of the first things to go in a lot of cases is education funding,” Cornelius said.

An April analysis by the Wisconsin Policy Forum found that technical colleges received an average of $17,153 per full-time-equivalent student in 2021. That was the fifth-highest funding in the nation compared with other states.

The University of Wisconsin System, which does not have local property tax authority under state law, received around $15,079 per full-time-equivalent student. That funding ranked Wisconsin eighth worst in the nation.

Wisconsin Public Radio, © Copyright 2026, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.