More than 12,000 Wisconsinites will see their student loans forgiven in the coming weeks under changes to federal income-based repayment programs as part of a broader push to offer debt relief to borrowers. But under state revenue codes, any loans that are discharged will be taxed as income.

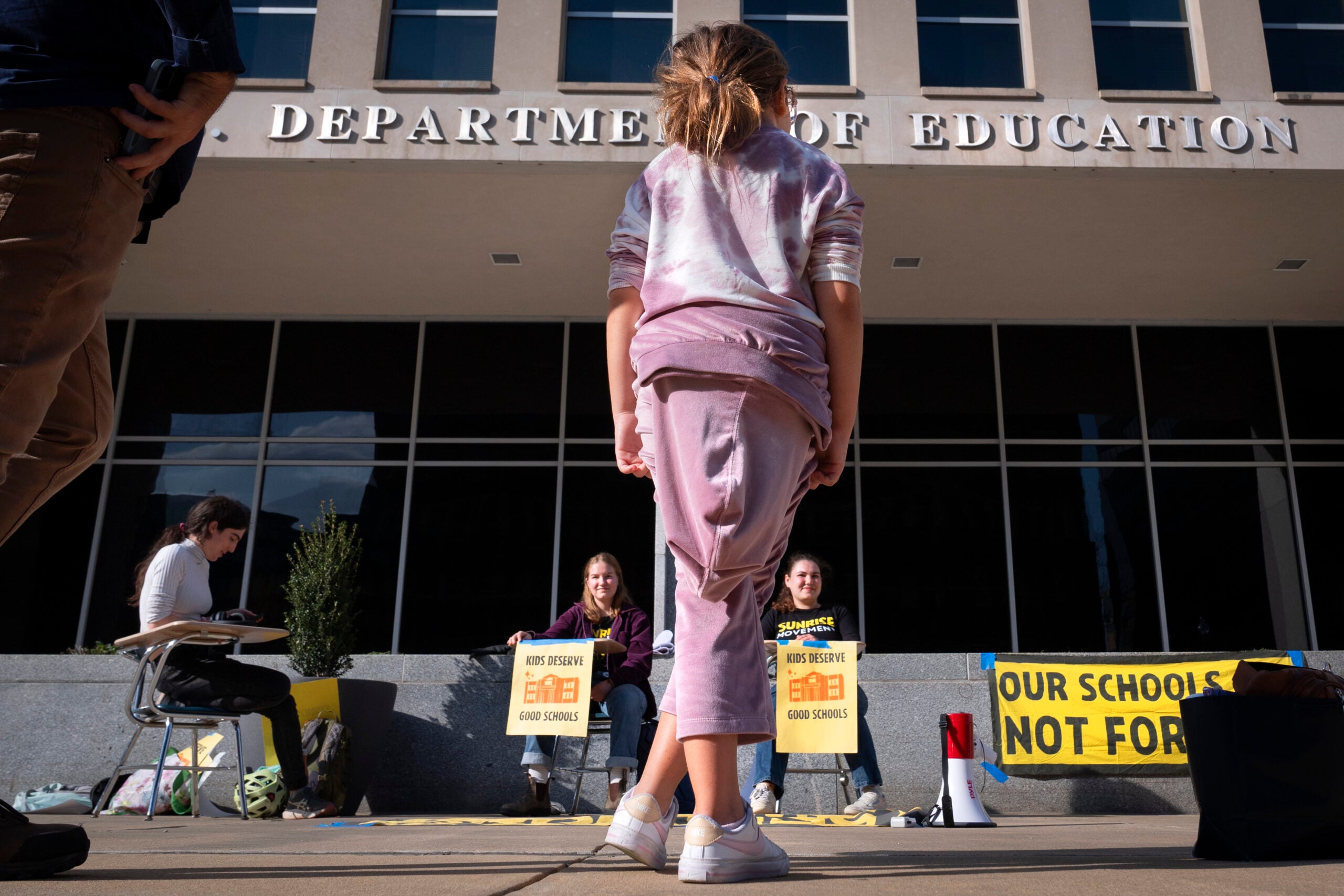

Since the U.S. Supreme Court struck down President Joe Biden’s plan to forgive up to $20,000 in student loan debt in June, the U.S. Department of Education has been making changes to repayment plans that are based on borrowers’ income.

The latest iteration is the Saving on a Valuable Education program, or SAVE, which began accepting applications this week. Borrowers who took out federal, subsidized or unsubsidized direct loans making less than $15 per hour won’t have to make any payments. Those who make more are expected to save around $1,000 per year over previous income-based plans, according to the department.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

Borrowers in income-based or income-driven repayment plans will see their debts discharged within 10 to 25 years, depending on how much their original balance was.

In a statement, Vice President Kamala Harris said tens of millions of Americans will be eligible for lower payments before a three-year pause on payments, initiated at the start of the COVID-19 pandemic, ends Oct. 1.

“Monthly payments will be based on income, rather than their total student loan balance,” Harris said. “In addition, as long as you make the monthly payments required under your plan, your loan balance will no longer grow because of unpaid interest – making sure that you make progress on paying down your debt.”

Susan Dynarski is a professor at Harvard Unviersity’s Graduate School of Education. She told WPR one of the biggest benefits to income-based borrowers in the SAVE program is an automatic annual renewal, which pulls income data directly from the Internal Revenue Service.

“In the past we’ve had some programs that looked pretty progressive and promising on paper, but the paperwork burdens were so great and the loan servicers, so not up to the task of getting people enrolled that they failed in their function,” Dynarski said.

Older income-based plans required borrowers to print tax records out and submit them to their loan servicing company. She said the point of income-based repayment was to make it easy for borrowers facing financial hardship to get relief.

“And putting lots of bureaucratic hoops in the way of people who are struggling financially is not the way to make it happen,” Dynarski said.

In July, the administration announced 804,000 borrowers would see a total of $39 billion in student loans discharged under tweaks to existing repayment plans based on income. In Wisconsin, that means 12,200 borrowers will see more than $576 million in debt forgiven. That works out to an average debt of around $47,144.

Nicholas Hillman is a professor with UW-Madison’s Department of Educational Leadership and Policy Analysis. He told WPR the federal government caps the amount of loans going to undergraduate students enrolled in four-year degree programs at $32,000, which means many in the income-driven repayment plans are likely graduate students.

“It is definitely a different person than somebody who went to school for one semester, took out some loans, got debt but no degree, and is now in default,” Hillman said.

Whether any loan forgiveness under income-driven repayment plans will be taxable varies by state. The American Rescue Plan Act of 2021, made changes to the federal tax code exempting the amount of loans forgiven from federal income tax.

Wisconsin has not adopted those federal changes, so borrowers in income-driven plans will see the amount of debt forgiveness they receive show up as gross income.

Hillman said he’s seen signs of potential lawsuits aimed at blocking changes to income-related repayment plans. He said student debt cancelation has become “a political football.”

“And now they’re coming out of the woodwork trying to stop any sort of debt cancelation,” Hillman said.

Also, he said he’ll be watching for future data on loan delinquency when student loan payments resume.

“Come October, once that repayment system gets turned back on, it’s going to be easy for some people who have privileges,” Hillman said. “But for a lot of people who are struggling already, it’s going to be tough.”

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.