Republican lawmakers say a nearly $3 billion tax cut proposal will bring relief to middle class Wisconsinites, including retirees.

An Assembly bill introduced Tuesday would use the state’s surplus to cut income taxes for Wisconsin’s third tax bracket from 5.3 to 4.4 percent starting in tax year 2023. That affects individuals with $27,630 to $304,170 in annual taxable income or joint filers making between $36,840 to $405,550.

“The third bracket is a large bracket, but it’s clearly where the middle class of Wisconsin is,” said state Rep. Mark Born, R-Beaver Dam, who co-chairs Wisconsin’s joint budget committee.

Stay informed on the latest news

Sign up for WPR’s email newsletter.

The new bill also would expand tax cuts for retirees who are at least 67 years old. It includes a tax exemption for retirement income up to $100,000 for individuals or up to $150,000 for joint married filers.

Although the retirement exemption is a new proposal, Democratic Gov. Tony Evers has already rejected one element of the new legislation.

This summer, he vetoed cuts for Wisconsin’s top two income tax brackets which included the bracket targeted by the latest bill. The governor blasted the version of the budget passed by the Republican-controlled Legislature by accusing it of focusing tax breaks on the richest Wisconsinites.

At a news conference Tuesday morning, Born said he hadn’t yet discussed the latest proposal with Evers.

“I take him at his word,” Born said. “He says he wants to provide tax relief for the middle class. This is an opportunity to do it with two proposals that impact the middle class and in very significant ways.”

In response to a request for comment, a spokesperson for the governor noted that Republican lawmakers previously rejected part of Evers’ plan for middle class tax relief, which included a 10 percent cut for individuals taking home $100,000 or less a year.

Spokesperson Britt Cudaback also pointed to a memo released by the governor’s budget director on Monday, which warned that Wisconsin could be in danger of losing federal pandemic relief funds if it cuts tax revenue too steeply.

Born said Tuesday he’s not worried that the proposed $2.9 billion in state tax cuts would lead to American Rescue Plan Act money being recouped.

“I don’t have any concerns about that,” Born said. “I think that these are things that they like to make threats on.”

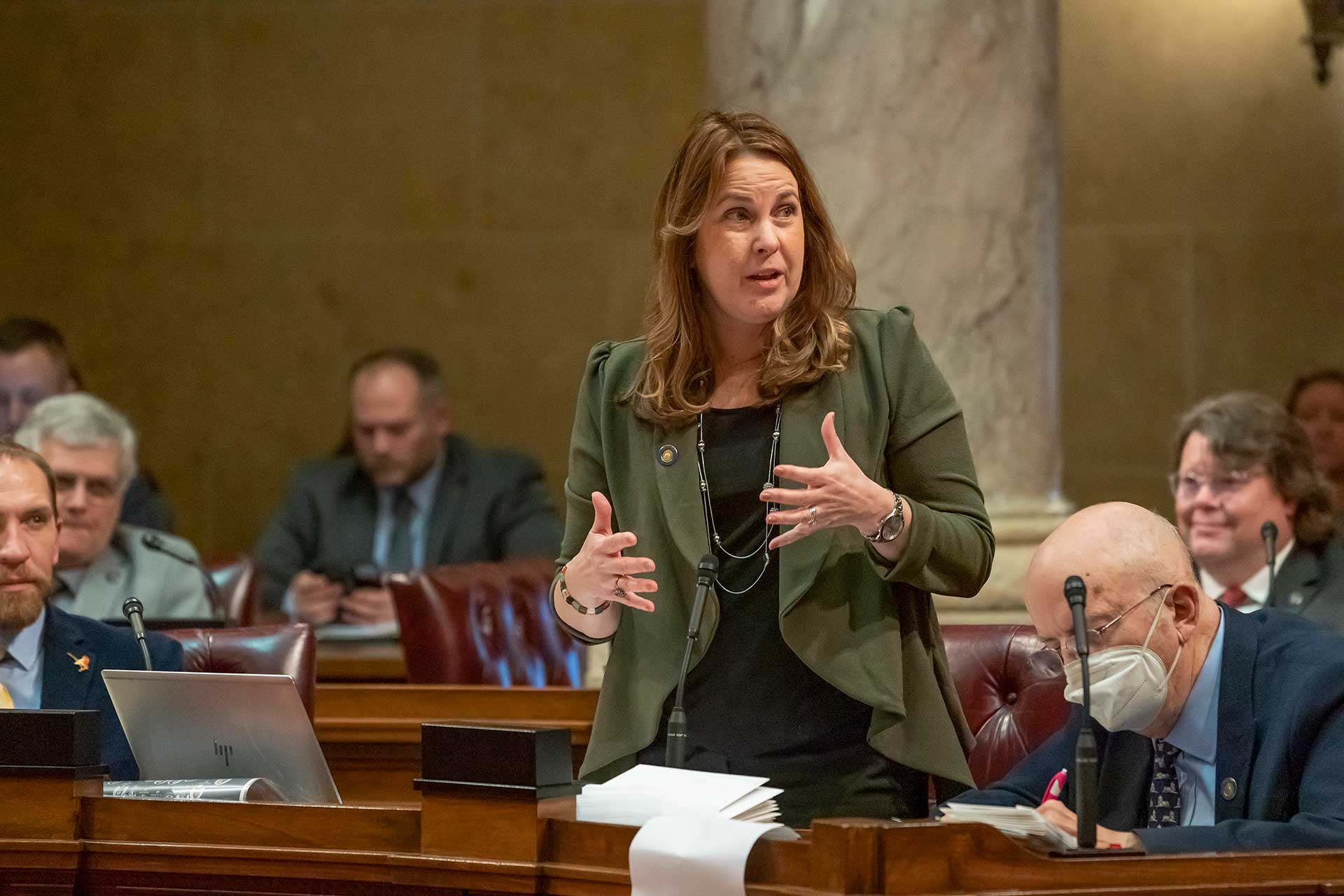

Democratic state Sen. Kelda Roys of Madison disputed Republicans’ characterization of their proposal as targeting the middle class.

“I think the problem is that Republicans have so flattened taxes in Wisconsin, that we’re considering the middle class along with people who are doing far better than the average Wisconsin family,” Roys said. “A person who’s making $30,000 or $40,000 or $50,000 a year is not in the same economic circumstances as people who are making $300,000 or $400,000 a year, and what we need is a more progressive graduated income tax that reflects people’s economic realities.”

Roys said the state should invest more in areas, including child care, public education, technical colleges and the University of Wisconsin system.

“Wisconsin doesn’t have a problem attracting retirees. We are having a problem attracting and retaining young people, young families and young workers, and if we’re going to have a successful economy, we have got to reverse that trend,” Roys said. “Republicans aren’t willing to do that because they don’t seem to care about solving our workforce challenges and helping our economy. They only want to cut taxes in a way that disproportionately benefits the wealthy.”

Wisconsin is projected to end the two-year budget cycle with a $4 billion surplus, and Republicans say much of that extra money should go to tax relief.

“We’ve invested a lot of money in a lot of key areas in this budget, including over $90 million in new funds into child care,” Born said. “The Legislature is not interested in spending more money …. The money that’s left needs to be returned to the taxpayers.”

Thus far, the tax cut bill has at least one Republican senator as a co-sponsor — Sen. Rachael Cabral-Guevara of Appleton, who said she believes there’s “across the board” support for tax cuts in the state Senate.

Also on Tuesday, Republicans introduced a joint resolution that would make it more difficult to raise taxes in Wisconsin.

Under the proposed constitutional amendment, approval by a two-thirds majority of both chambers of the state Legislature would be needed to raise income, sales or franchise taxes.

“By doing this, we’re protecting our citizens from getting overtaxed,” said Rep. Amy Binsfield, R-Sheboygan. “We do not want to see people leaving the state over over-taxation.”

In order to change Wisconsin’s process for raising taxes, that proposal would first need to be approved by two consecutive sessions of the state Legislature. Then, it would need to be OK’d at the ballot by a majority of Wisconsin voters.

Wisconsin Public Radio, © Copyright 2025, Board of Regents of the University of Wisconsin System and Wisconsin Educational Communications Board.