President-elect Donald Trump campaigned on a range of tax promises, from making tax cuts passed in 2017 permanent to eliminating Federal Income taxes on overtime and Social Security.

Wisconsin’s longest-serving member of Congress says getting those proposals passed is another story.

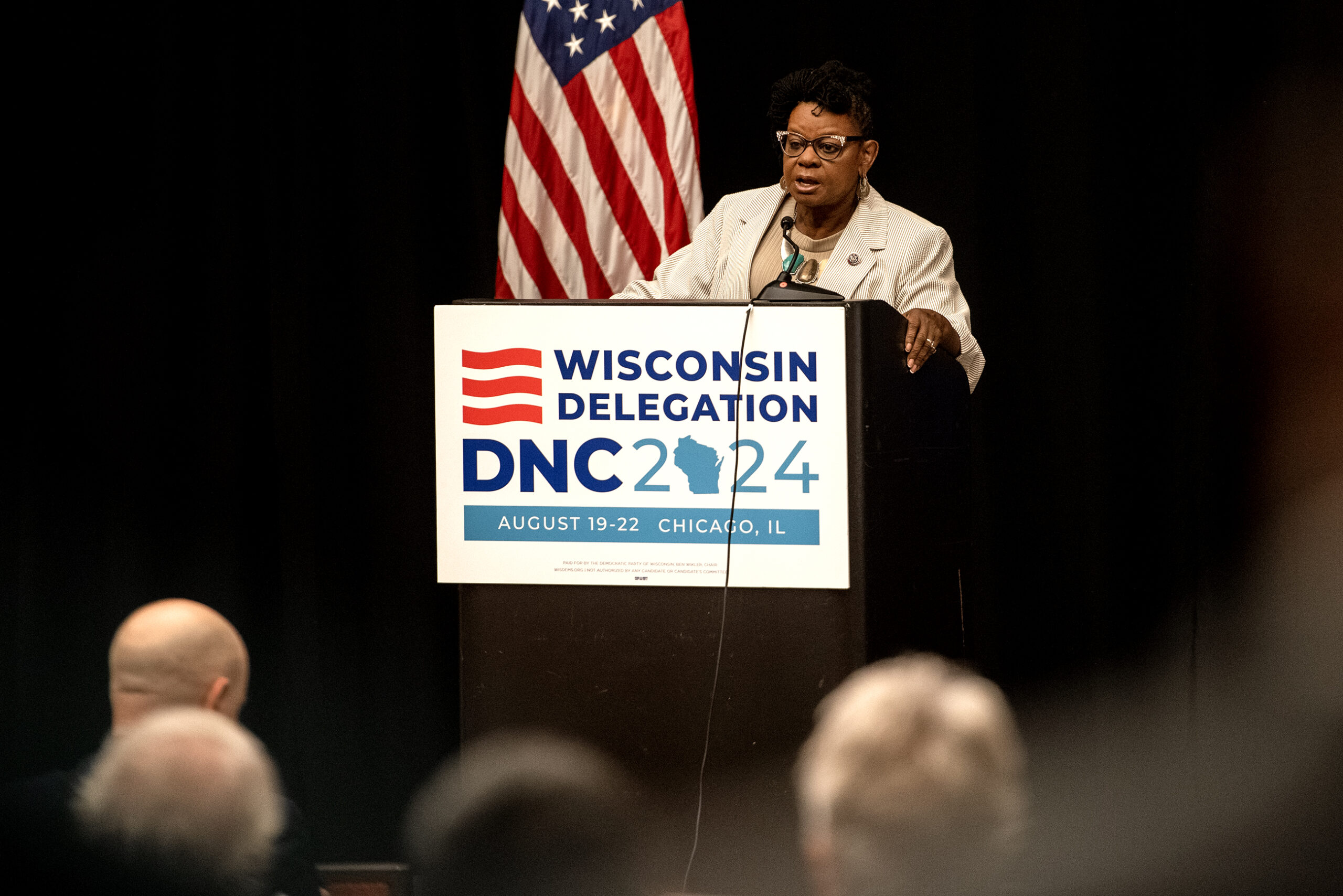

Democratic Rep. Gwen Moore of Milwaukee was re-elected in November and serves on the House’s Ways and Means Committee, which shapes legislation on taxes and social service programs. She told WPR’s “Wisconsin Today” that she believes Republicans won’t be able to enact policy alone.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

“Republicans proclaim this (election) to be a mandate. It is not a mandate,” Moore said. “The margin in both the Senate and particularly in the House is very, very thin. So I think that they’re going to find that they’re going to have to cooperate with us.”

Former Trump Treasury Secretary Steven Mnuchin told CNBC earlier this month that making permanent tax cuts implemented in Trump’s first term will be a top priority for his second term. Doing so would add $4.6 trillion to the deficit over the next ten years, according to the Senate Budget Committee.

Moore said members of the Joint Economic Committee are aiming to make these tax cuts budget neutral — potentially leading to cuts on safety net programs.

“They’re talking about block-granting Medicaid, which means that any other people who would ordinarily be eligible for Medicaid will find themselves unable to get that care because it’s being (used) by our seniors, people in nursing homes,” Moore said. “It really would block younger people, kids, families, and other people from receiving it.”

Eliminating federal income tax on Social Security could save retirees money, harm the program long-term

Forbes estimates that eliminating federal income tax on Social Security could save retirees more than $135 billion per year and reduce federal government revenue by 2.7 percent.

According to the nonpartisan Committee for a Responsible Federal Budget, Social Security is already on track to run out of money by 2034. A report from the group last month found Trump’s proposed tax policies — like eliminating federal income tax on Social Security and overtime pay and imposing tariffs on imports among other policies — would lead to Social Security running out of money three years earlier.

“Everybody likes a free lunch. And what we have found out is that there is no such free lunch,” Moore said. “Social Security is paid for by our payroll tax … (this policy) is a feel-good thing, but it really undermines Social Security and it’s a really bad, bad idea.”

Republicans and Democrats support the child tax credit. They disagree on specifics.

Moore is also in contention with her Republican colleagues over changes to the IRS’ child tax credit. This credit allows families with qualifying children to receive a tax break if the children and parents meet certain conditions.

The child tax credit is not new, dating back to 1997. But during the COVID-19 pandemic, the tax credit was expanded to families regardless of income or tax liability. The child poverty rate was cut in half during this period, according to data from the United States Census Bureau.

Trump, Vice President-elect JD Vance and Vice President Kamala Harris have all voiced support for the child tax credit, with both Harris and Vance promising this year to boost the credit.

But earlier this year, Senate Republicans argued that there should be more strict work requirements for the child tax credit. Moore said that work incentives for safety net programs aren’t as effective as Republicans claim.

“(With) a work requirement for Medicaid, a work requirement for SNAP — what we have found is that these do not create true work incentives. It forces people into the low-wage workforce and it doesn’t really create pathways to long-term employment and getting out of poverty,” Moore said. “It just jerks people around and mostly it denies them benefits to which they would otherwise certainly be entitled.”