Beginning in January 2025, more than 72.5 million Americans will receive a 2.5 percent increase in their Social Security benefit payments. That’s due to an annual cost-of-living adjustment designed to help beneficiaries keep up with changes in the Consumer Price Index.

But how much longer can the Social Security program itself keep up with demographic, economic and sociological shifts in our society?

Recently, Karen Holden, professor emerita at the University of Wisconsin-Madison’s La Follette School of Public Affairs, visited “The Larry Meiller Show” to discuss all things Social Security.

News with a little more humanity

WPR’s “Wisconsin Today” newsletter keeps you connected to the state you love without feeling overwhelmed. No paywall. No agenda. No corporate filter.

The basics of Social Security

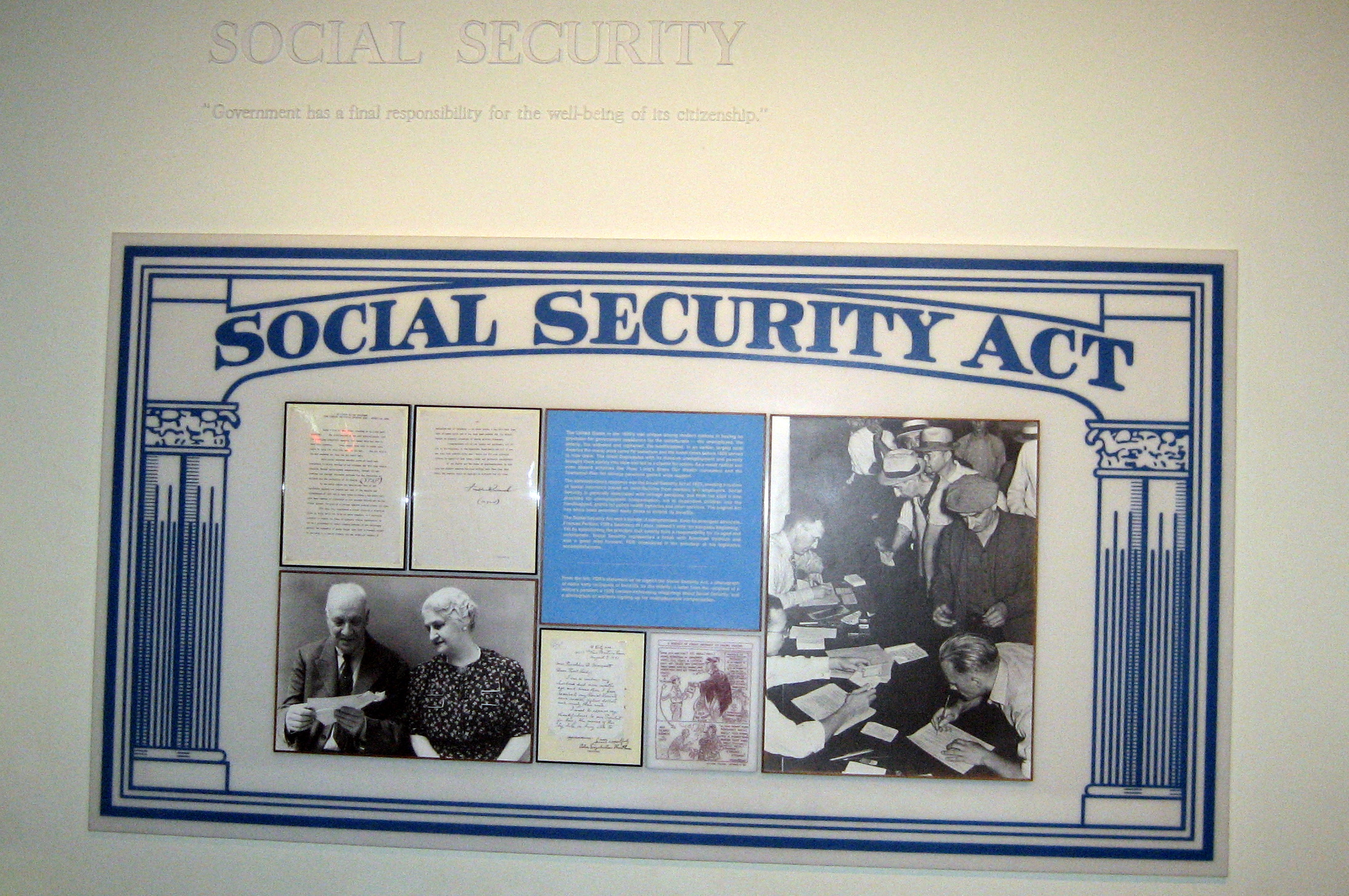

Social Security was established when President Franklin D. Roosevelt signed the Social Security Act of 1935 into law. It is now the largest federal program in the United States with an estimated 1-in-5 Americans collecting benefits.

“Social Security was a consequence of the Depression,” Holden said. “It has been a foundation for our pension and health care systems. It has enabled people to have some income in retirement. It was never supposed to be enough income for retirement but rather a foundation for living through retirement.”

Holden said many wrongly assume Social Security will provide enough income to live on after they retire.

“You do not want to think that,” said Holden.

Holden explained the basics of the program: “You and your employer pay into the Social Security trust fund through payroll taxes. When you reach full retirement age, which is now 67 years old, you will qualify for Social Security benefits based upon your average earnings over a 35-year period.”

For new applicants, Holden noted, “You can receive Social Security as early as age 62. However, you can’t get full benefits until age 67.”

Holden said it is important to know that if you choose to take Social Security benefits before your full retirement age, the reduction in benefits you will receive is permanent, meaning you won’t ever be able to collect your full benefits.

To account for longer life expectancies, the full retirement age was changed in 1983 from age 65 to age 67.

Changes in Social Security

In addition to when Social Security benefits can be received, there have also been changes to who can receive the benefits. In 1939, the Social Security Act was amended to allow benefits to go to spouses and children of retired workers as well as to families of deceased workers.

Initially those survivor benefits were meant just for women, but in 1977, the United States Supreme Court ruled that Social Security had to provide equal survival spousal protection for both genders.

“I’m proud to say that Social Security is gender neutral,” said Holden.

Holden also feels that the transparency of the Social Security Administration is one of the program’s main virtues.

“There’s a board of trustees that oversees the program every year and they look at all the provisions and see how the provisions affect the beneficiaries and the financing.”

The trust fund

Holden addressed concerns about the Social Security trust fund, the dedicated pool used to fund the program and running out of money:

“More than 90 percent of the trust fund is funded by payroll tax,” she said. “Payroll taxes have not always been enough to cover the benefits the program pays out. So right now, the trust fund is projected to run out in 2035. If that happens, the program will still be able to pay about 83 percent of scheduled benefits. So, the question really is figuring out how Social Security can be adjusted so it can pay out 100 percent of the promised benefits.”

Holden said it is the responsibility of Congress to ensure that the trust fund is not depleted.

Holden acknowledged that raising the minimum wage would result in more income coming into the Social Security trust fund. Conversely, the revenue going into the trust fund would be reduced if taxes were no longer collected on the tips received by service workers.

Holden also pointed out while undocumented workers can’t receive Social Security benefits — “It is very hard to get a Social Security number if you are not a citizen or resident” — they are nevertheless paying billions into Social Security through their payroll taxes.

“In fact, the incentive is for an undocumented worker not to try and get benefits because they would be reported to the Department of Homeland Security,” she said.

Holden stated that deportation of undocumented workers could have a negative financial impact on the Social Security trust fund.

“Another shift that is affecting the trust fund is our lower fertility rate,” continued Holden. “In 2022, the total fertility rate was about 1.6 or about half of what it was in the 1950s. This means the number of workers paying into Social Security is declining, which is a problem compounded by the overall aging of the population.”

Social Security benefits and taxes

Holden pointed out one way the Social Security program has continued to remain solvent over the past 40 years is through the federal taxation of benefits.

“Up until 1983,” explained Holden, “Social Security benefits were not taxed. Then the federal government established policy that said Social Security was taxable income. If a taxpayer’s income is above a certain threshold, either 50 percent or up to 85 percent of their Social Security benefits may be taxed.”

Holden stressed that money collected from those taxes goes back into Social Security and is not used to fund other programs.

However, Social Security benefits are not taxed at the state level in most states, including Wisconsin.

When computing if a taxpayer’s income is enough for their Social Security benefits to be taxed, Holden said “commission, bonuses, severance pay — those items count as wages. Social Security does not count employer-sponsored health insurance, pensions, annuities, investment income, or interest as income when calculating the taxation of Social Security benefits.”

A current law affecting the solvency of the trust fund is that Social Security payroll taxes do not apply on income above a certain threshold.

In 2024, that level is $168,600, meaning that millionaires stopped paying into the program sometime in March. Holden predicted this could change and calculated about a third of the current trust fund gap could be covered by raising the income cap on payroll tax exemption.

For more information

Holden strongly recommended exploring the Social Security Administration’s website:.

“You can set up your own account, look at your benefits, it really is a marvelous site. In fact, if you call your local Social Security office to set up an account, they’ll first direct you to the website,” she said.

The last word

To address current challenges to the program, Holden senses changes coming to Social Security laws before its 100-year anniversary in 2035.

“We have not taken a serious look at it since 1983,” she said. “Now is the time to look at it.”